Indian stock indices have shown remarkable resilience despite of sustained scepticism in the minds of most investors.

It has now come out of the congestion zone of two month uncertainity

It would appear that the Indian markets are strongly headed for the next higher orbit. If we look at the last 5 years performance the Nifty index has not performed well having registered only a CAGR growth of 10%. Now is the catchup time notwithstanding negatives like inflation, geo-political situation.

Most midcaps just bounce back after brief time wise corrections

In the Nifty Bank index PSU banks have led from the front although State Bank is the only one that has significant weightage in the index. Most PSU banks have multiplied more than 3-4 fold from there Covid lows.

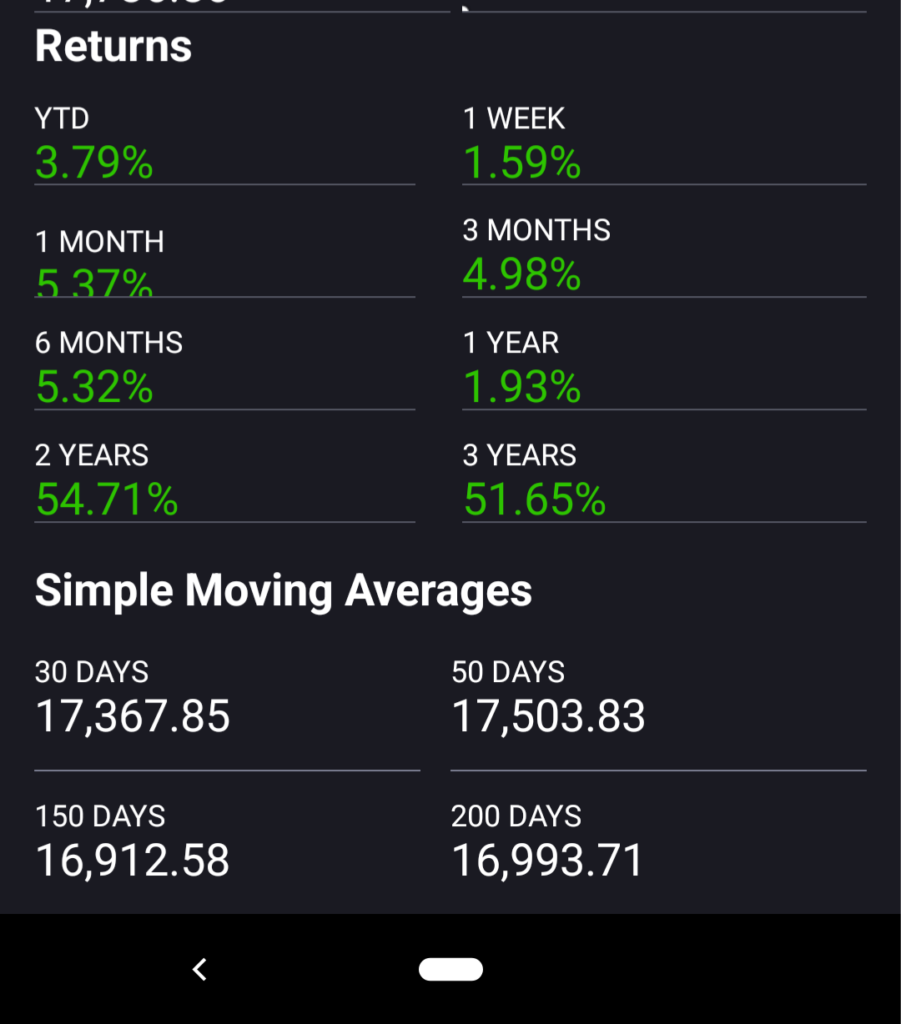

Index image is a screen snapshot from Moneycontrol